illinois employer payroll tax calculator

100 Accurate Calculations Guaranteed. Illinois payroll tax calculator info for business owners and payrollHR managers.

How To Get An Accounting Job With No Experience Comptabilite D Entreprise Le Contrat De Travail Bourse

Illinois child support payment information.

. Just enter the wages tax withholdings and other information required. Online - Employers can register through the. Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today.

Ad Compare This Years Top 5 Free Payroll Software. Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use. The following points apply to Illinois payroll taxes.

The Illinois Paycheck Calculator uses Illinois. Unemployment insurance FUTA 6 of an employees first 7000 in. The maximum an employee will pay in 2022 is 911400.

The Illinois Paycheck Calculator is designed to help you understand your financial situation and determine what you owe in taxes. A state standard deduction exists in the form of a personal exemption and varies. Carol Stream IL 60197-5400.

Try Our Free And Simple Tax Refund Calculator. Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator.

The maximum an employee will pay in 2022 is 911400. Newly-created businesses employing units must register with IDES within 30 days of start-up. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4.

For more IDES employer contact information or call. The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. You may pay up to 050 less an hour for your new hires in their first 90 days of employment.

That makes it relatively easy to predict the income tax you. Tax withheld 0495 x wages line 1 allowances x 2375 line 2 allowances x 1000 number of pay periods. For assistance on Illinois payroll tax.

Ad Compare This Years Top 5 Free Payroll Software. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. All Services Backed by Tax Guarantee.

Illinois Income Tax Brackets and Other Information. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Illinois State Disbursement Unit. Remit Withholding for Child Support to. Your employer will withhold money from each of.

There is a flat rate of taxation on net income which is 495. Latest payroll taxes rates related laws for the state of Illinois. The standard FUTA tax rate is 6 so your max.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. This applies to workers over the age of 18. Illinois payroll taxes are exempted for the employees who are non-residents in.

Free Unbiased Reviews Top Picks. The state income tax rate in Illinois is a flat rate of 495. The Employer Services Hotline at 800.

The calculator on this page is provided through the adp. Mail completed forms and payments to. Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Free Unbiased Reviews Top Picks. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our.

Ad Payroll So Easy You Can Set It Up Run It Yourself. In 2022 the illinois state unemployment insurance sui tax rate will range from 0725 to 71 with a maximum.

Payroll Tax Calculator For Employers Gusto

![]()

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

2022 Federal State Payroll Tax Rates For Employers

Payroll Tax What It Is How To Calculate It Bench Accounting

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How To Set Up Pay Payroll Tax Payments In Quickbooks

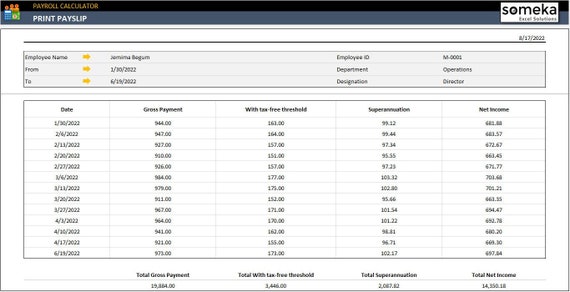

Using Excel For Tax Calcs Jun 2019 Youtube

How To Calculate Payroll Taxes Taxes And Percentages

2022 Federal Payroll Tax Rates Abacus Payroll

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

What Are Payroll Deductions Article

Income Taxes Preparing A U S Tax Form With Money In Mind Sponsored Preparing Taxes Income Tax Mind Ad Income Tax Tax Refund Tax Services

Tax Debt Help Bear De 19701 Tax Debt Debt Help Payroll Taxes

Payroll Calculator Excel Template To Calculate Taxes And Etsy Canada